Are Traditional Healthcare Providers Really at Risk From the Disruptors? New Studies Cast Ominous Shadows

The evidence is coming in in one very important area, and it should be concerning to all the leaders of traditional patient care organizations—hospitals, medical groups, and health systems—the “bricks and mortar” institutions in U.S. healthcare.

Three recent studies point to very worrisome issues for traditional provider organizations. One was prepared by the Boulder, Colo.-based Navigant, a Guidehouse Company, and sponsored by the New York-based Centric Digital, the other, prepared by Redpoint Digital.

The study prepared by Navigant, and written by Danielle A. Dyer, is entitled “Healthcare Consumer Digital Experience Analysis.” As Managing Editor Rajiv Leventhal noted in his Feb. 20 report, “[D]isruptors are outperforming nine out of 10 health systems when it comes to providing a seamless, integrated digital experience. This digital engagement expertise is putting health systems at risk of losing consumers to disruptors offering more routine, lower-acuity care, the analysis suggested.”

Leventhal wrote, “A provider’s online experience often serves as a digital introduction for awareness and consideration of the care they offer, and how and where consumers can receive that care, according to the researchers. The analysis of the digital presence of more than 1,400 hospitals and health systems found that 90 percent of health systems’ consumer digital experience scores were lower than the lowest scoring disruptor. Some of the innovative players in this space that the report mentions include companies such as Oscar, Zocdoc, One Medical, and CVS Health.”

What the Navigant study found was this: when it comes to digital best practices, including search engine optimization, safe browsing and communication, website homepage speed/usability/accessibility, and mobile optimization, traditional health systems are doing relatively poorly compared to disruptor organizations, which the study defines as payers, retail pharmacies, and other non-traditional providers of care.

According to the report, “The average score for health systems was 635 out of 1,000, compared to 771 for disruptors across five categories: online provider finders, innovative payers, health retailers, urgent care, and IT-enabled primary care. The analysis also found:

● Disruptors outperform health systems by over 140 points with search engine optimization for care needs.

● Only 45 percent of health systems allow consumers to search for available appointment times/request appointment information without logging into a portal, compared to 75 percent of disruptors.

● Only 3 percent of health systems have public chat.”

And it quoted Subra Sripada, a former health system CIO and currently the partner and healthcare technology leader at Guidehouse, as saying that “Disruptors are not only seizing the consumerization of healthcare in providing access, convenience, choice, and price transparency for lower-acuity services, they are also reaching customers with Amazon-like capabilities built into their tools. This is one example of how disruptors—the same organizations aggressively competing with traditional providers for market share—are changing the healthcare landscape. Hospitals and health systems need to revisit their access strategies and bolster their tools to both protect their market and drive differentiation.”

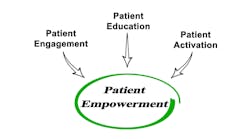

The report did reveal that leading providers are investing in digital. Eighty percent of hospital and health system CFOs believe digital transformation is critical for their organization's long-term survival and to continue to provide high-quality patient services. One example is via Apple Health Records; some 330 health institutions now support the feature, which enables patients to view data such as immunizations, lab results, medications, and vitals directly in the Health app. Two years ago, just 39 healthcare providers were on board. Still, consumers are far from thrilled at their options. As Leventhal noted, a separate report from the Pittsburgh-based Center for Connected Medicine, entitled “The Future of the Digital Patient Experience,” has found that “many health systems have work to do when it comes to implementing patient-facing digital health tools. Tools need to be used by patients, integrated with the health system’s existing technology infrastructure such as electronic health records, and provide a robust and user-friendly experience. These observations also are backed up by recent CCM research. The Top of Mind 2020 survey, published in November 2019, looked at health system use of patient engagement technology and found that investment has focused primarily on patient portals and largely ignored third-party apps. The reasons for this are understandable. Health providers have spent millions of dollars standing up electronic health record systems and meaningful use requirements have pushed health systems to offer patients access to health data via the portal. Integration of third-party apps, meanwhile, traditionally has been difficult due to challenges with interoperability of health care data.” That report found that half of respondents in a survey said that implementing digital health tools for patients is a critical or high priority for their health system; but also that most digital tools currently in place are still focused on basic functions such as helping patients access their health records, make appointments, pay bills, and search for a doctor. Cost is the biggest barrier to advancement, that survey found.

Meanwhile, as Leventhal reported on Feb. 24, “according to a new report, many consumers still report facing major frustrations throughout the experience. The analysis from the Wellesley Hills, Mass.-based Redpoint Global, included responses from more than 1,000 U.S. adult consumers. Nearly half feel they are not receiving a holistic experience from their healthcare provider. The data showed that 71 percent of responding consumers experience significant frustrations with their healthcare experiences, including long wait times, impersonal visits, a confusing process, and trouble when scheduling an appointment.” And, fully 75 percent of consumers want a more personalized experience, according to the report, prepared by Dyanata for Redpoint, and published on Feb. 18.

What’s more Leventhal noted, according to the researchers, taking “a data-driven approach is critical for healthcare organizations to meet rising consumer expectations. Unifying first-party, second-party, and third-party data in a single customer view enables healthcare providers to know all that is knowable about each consumer and use it to deliver real-time, personalized engagements that improve outcomes.”

The survey also found that consumer satisfaction in healthcare is low, with over half of consumers saying that they would rather endure a typically frustrating experience – such as waiting at the DMV or going to jury duty – than deal with a health insurance issue. One of the main ways patients want healthcare organizations to eliminate friction is by offering digital communications: 58 percent of consumers said that they prefer their healthcare interactions to be digital. Meanwhile, 54 percent of consumers feel that their healthcare providers and insurers don’t have all the contextual information needed to personalize healthcare recommendations. Patients want the experience to be more personalized and catered to them as individuals: 61 percent said they would visit their healthcare provider more often if the communication experience felt more personalized.

And so… all of this is challenging to the leaders of traditional patient care organizations—on multiple levels. The reality is that the ways in which hospitals, medical groups, and health systems operate, on a day-to-day basis, remain both very provider-focused and very process-focused, rather than patient-focused or consumer-focused. Anyone who’s sat in a waiting room for two hours waiting for their doctor to get through an over-crowded schedule, knows what I mean by that.

What’s more, until recently—and still now, in many, many patient care organizations—being patient-centric or consumer-centric has amounted to very small-bore steps to try to improve convenience, such as using patient portals for physician appointment scheduling; not that there’s anything wrong with that—it’s a good first step—but only that.

What looks to many observers like a coming tsunami, is this: as the younger generations turn to the healthcare delivery system for patient care, they will be far less patient with the entire way in which the delivery system is structured. And the greatest pressure will fall on primary care physician practices, because while patients continue to have some level of (sometimes-exasperated) patience with access to specialists, as they know about the specialist shortages in so many areas, they are far less patient when it comes to accessing primary care.

And that is why all the potential and actual disruptors—CVS/Aetna, WalMart and Humana, and many other entities—really are set to truly disrupt the healthcare system, because of consumers’ dissatisfaction with a range of issues in the traditional system. Let’s face it: most senior executives and leaders at most traditional patient care organizations are still thinking of their digital capabilities as being “nice-to-have extras,” rather than as essential feature of how they’ll need to be operating in the future.

In particular, two elements are becoming clear that could have a major impact on traditional providers and provider organizations. First, consumers are rejecting the inconvenience of traditional care delivery whenever they have the option. They are turning to urgent care centers for minor but timely issues, such as coughs, colds and flu, sore throats, and other health issues. And, they are willing to pay more for the convenience of seeing a provider quickly. And, related to that, younger healthcare consumers, from all indications, feel far less loyalty to their primary care physicians than do many older healthcare consumers (and even some older consumers are shifting in their perceptions and impulses, in that regard). That bodes well for CVS/Aetna in its plans to create thousands of minute clinics nationwide, and for all similar initiatives; and it potentially weakens a core assumption that the senior executives of so many integrated health systems have been working on—that patients’ loyalty to their primary care physicians will continue to translate into some overarching loyalty to health systems, a theory that was never totally solidly founded, and is becoming less so in highly competitive urban and suburban healthcare markets nationwide.

There are good-news stories out there, of course. As I wrote last summer, on July 13, at our Healthcare Innovation Summit in Denver, Gina Altieri, senior vice president, corporate services, at the Wilmington, Delaware-based Nemours Children’s Health System, described her organization’s multi-year journey around improving service and capturing loyalty among its community members. Under the heading “Developing a Technology Strategy to Increase Patient Engagement, Improve Satisfaction, and Deliver Better Care,” Altieri described how the leaders at Nemours have pursued many different elements of an overall initiative at once, making telehealth visits more convenient and accessible, providing a very robust online consumer health information online source, posting physician outcomes online, and, of course, making physician-visit scheduling far easier through online self-scheduling.

“One misconception about companies like Amazon and Lyft,” Altieri said last summer in Denver, “is that it was the technology that changed everything” in terms of those companies’ abilities to disrupt their business sectors. “But it wasn’t the technology alone that was a disruptor. It was that they met the consumer where they were. And if we don’t provide the consumer with what they want, they’ll go elsewhere.” Exactly that. Indeed, the disruptors already know that, and are making their plans accordingly.